GAP Waiver

Guaranteed Asset Protection

Protect yourself in case of a total loss—and avoid unexpected out-of-pocket expenses.

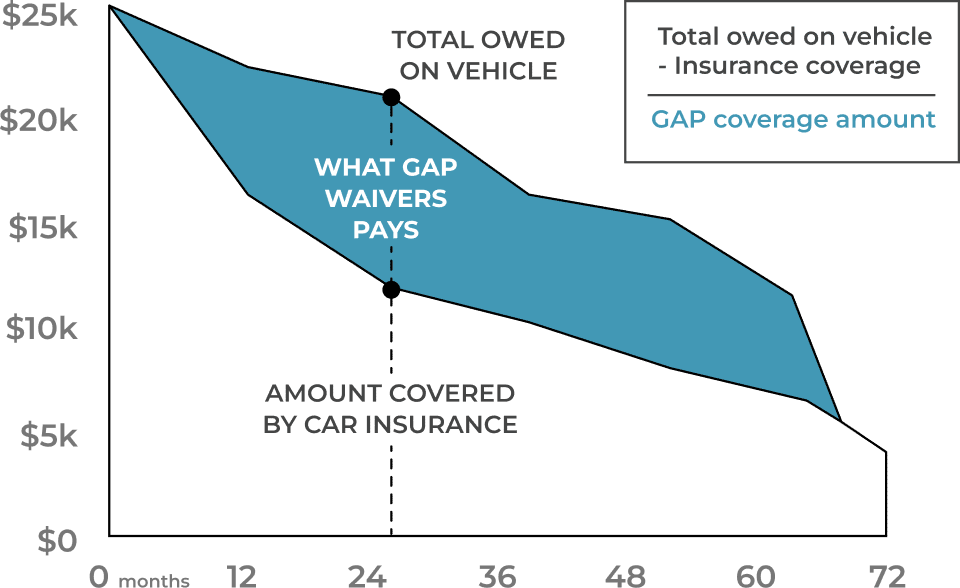

How the GAP Waiver Works: Payoff Example

- Loan Amount: $25,000

- Term: 60 months

- Loss Date: 36 months

- Loan Payoff Due: $15,000

- Insurance Settlement: $10,000

- Difference Between Insurance and Payoff: $5,000

- Plus Insurance Deductible: $500

What You Owe (Gap + Deductible): $5,500

GAP Waiver Pays: $5,500

This debt cancellation benefit helps cover the remaining loan balance that your insurance policy doesn’t pay—offering serious peace of mind when the unexpected happens.

What Is GAP Insurance (Guaranteed Asset Protection)?

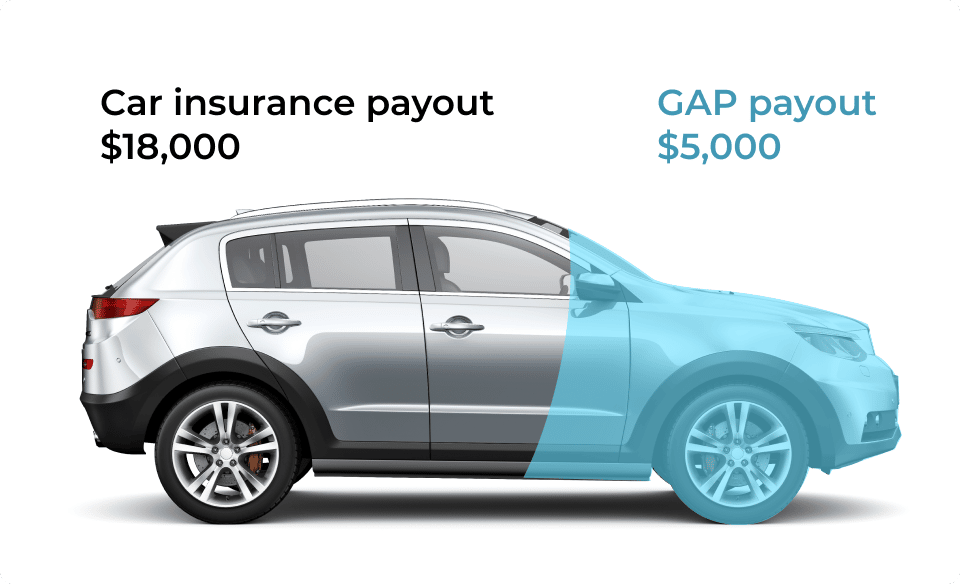

Guaranteed Asset Protection, commonly known as GAP insurance, is designed to cover the difference—or gap amount—between your car loan or auto loan balance and your car’s actual cash value in the event of a total loss due to accident or theft.

When a motor vehicle is totaled, your insurance company typically pays only the vehicle’s actual market value at the time of loss. That amount may be significantly less than what you still owe on your loan balance—especially early in your loan term, when depreciation hits hardest. A GAP waiver steps in to protect you from that financial shortfall.

GAP Benefits

Covers the GAP Amount between the insurance company’s settlement and your loan balance, including up to $1,000 in auto insurance deductibles

- Available for new cars, new vehicles, and refinanced auto loans

- Terms of up to 84 months and up to 125% of the vehicle’s MSRP

- Protection for motor vehicles valued up to $100,000

- Works with refinancing and refinance options

- May be eligible for a full refund if canceled early and unused (see disclosures for details)

In addition to canceling the gap amount, a GAP waiver can also help you avoid missed payments, late fees, and potential damage to your credit score after a total loss. It acts as a financial safety net, especially helpful for those with little or no equity in their vehicle. Whether you’re just starting your auto loan or several years into it, GAP helps ensure you’re not burdened with paying off a car you no longer have. It’s affordable, often costing less than a cup of coffee per month, and offers a level of peace of mind that traditional insurance products alone can’t provide.May be eligible for a full refund if canceled early and unused (see disclosures for details)

More Than Just Insurance—It’s Protection

Unlike traditional insurance products, GAP waivers are typically issued as an addendum to your auto loan agreement. While GAP is not required by law, it is often recommended by lenders, credit unions, and creditors as a safeguard against financial hardship.

And unlike optional credit insurance or service contracts, GAP does not reimburse you—it cancels the gap amount entirely, preventing you from falling behind on payments or harming your credit after a total loss.

Eligibility & Exclusions

Eligibility varies based on your loan term, vehicle value, and lender. Certain exclusions may apply based on state insurance laws, vehicle use, or loan structure. Make sure to review all disclosures and confirm your eligibility before enrolling in GAP coverage.

If you previously purchased gap insurance through a dealership, you may qualify for a full refund on that unused policy if you refinance or trade in your vehicle. Keep in mind that dealership GAP coverage often cannot be transferred to a refinance or new loan.

Why GAP Matters for Borrowers

Many borrowers don’t have immediate access to thousands of dollars if a vehicle is totaled. GAP gives you a buffer—covering that gap amount so you can focus on moving forward, not falling behind. It’s especially valuable for people with longer loan terms, lower interest rates, or those who made a smaller down payment.

Whether you’re buying a new car, refinancing an existing car loan, or working with a credit union, a GAP waiver helps preserve your financial stability and offers peace of mind in the event of a loss.

Interested in GAP Waivers or Need Advice?

Call us at 844.276.3272 to talk to a Loan Specialist and learn how GAP can fit into your auto loan or refinancing plan.

We’ll help you explore loan protection options, walk you through eligibility requirements, and ensure you’re not left covering the remaining loan balance after a total loss.